What Happens When You Don't File a 1099? - TurboTax Tax Tips & Videos

Learn about what happens if you forget to file a 1099. See how to fix mistakes, amend your return, and avoid potential issues with the IRS.

When to Use Tax Form 1099-C for Cancellation of Debt - TurboTax Tax Tips & Videos

On The Mend: What Is A 1099 Tax Form and What If I Forgot to File It? - Intuit TurboTax Blog

TurboTax 2022 Form 1040 - Enter Form 1099-DIV for Dividend Income

What to Do If You Don't Receive Your Form 1099 by January 31st

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

How to file the *new* Form 1099-NEC for independent contractors using TurboTax (formerly 1099-MISC)

1099-NEC Schedule C won't fill in : r/TurboTax

TurboTax Deluxe 2023 Tax Software, Federal & State Tax Return [ Exclusive] [PC/MAC Disc] : Everything Else

Forget the Forms—TurboTax Has You Covered - TurboTax Tax Tips & Videos

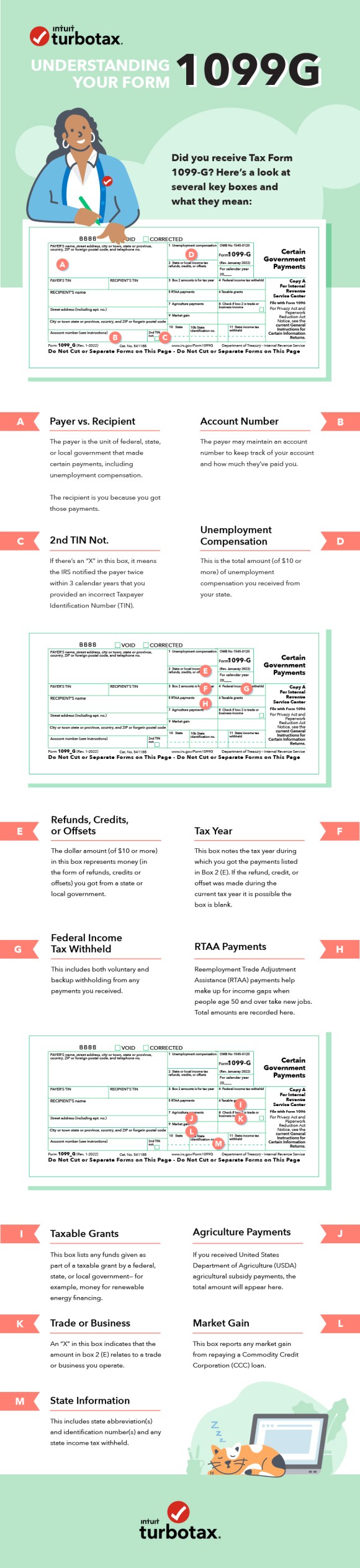

A Quick Guide To Tax Form 1099-G - Intuit TurboTax Blog

Video: How Does a Furlough or Lay-off Impact Your Taxes - TurboTax Tax Tips & Videos

Video: IRS 1099 Levy Contractor Options - TurboTax Tax Tips & Videos

.png)

Taxes & Write-Offs: Explained

/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/filer/59/3d/593d35d2-1c4c-4dba-8206-4b4e7035cfdd/oct018_c01_asksmithsonian-web.jpg)