Tax Brackets in the US: Examples, Pros, and Cons

:max_bytes(150000):strip_icc()/Tax_Bracket-Final-1824baf32c144f4db2f9ca7c7e8a5faa.jpg)

Description

A tax bracket is a range of incomes subject to a certain income tax rate.

:max_bytes(150000):strip_icc()/free-trade-agreement-pros-and-cons-3305845-final-5b71e37f46e0fb002cdbc389.png)

Pros and Cons of Free Trade Agreements

People always say that after a certain point, it's not worth working overtime anymore because of the higher tax bracket you're put in. Is this true? - Quora

:max_bytes(150000):strip_icc()/GettyImages-88305470-1--57520b1c5f9b5892e8bfc1a0.jpg)

What Is Adjusted Gross Income (AGI)?

:max_bytes(150000):strip_icc()/Tax_Bracket-Final-1824baf32c144f4db2f9ca7c7e8a5faa.jpg)

Tax Brackets in the US: Examples, Pros, and Cons

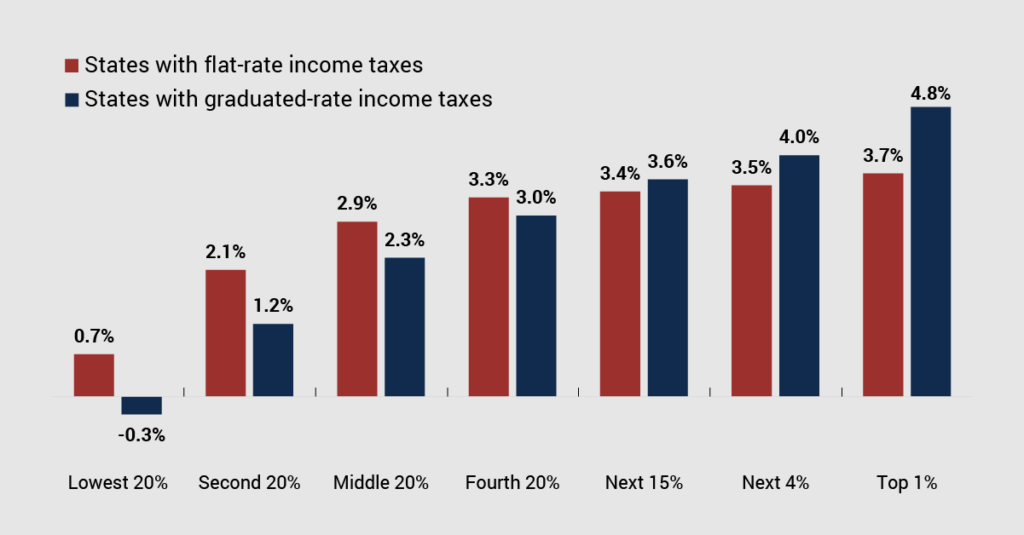

The Pitfalls of Flat Income Taxes – ITEP

:max_bytes(150000):strip_icc()/universal-health-care-4156211_final-5737902ad86c462e930875d1c0878130.png)

What Is Universal Health Care?

Effective Tax Rate: How It's Calculated and How It Works

:max_bytes(150000):strip_icc()/grossincome-ea78c4765b7b48999138d5512646f591.jpg)

What is Gross Income? Definition, Formula, Calculation, and Example

LLC Taxation Options: Which is best for your business? - Venn Law

:max_bytes(150000):strip_icc()/taxreturn.asp-FINAL-6421636a087d471d8c9b2e1a9788c577.png)

Tax Definitions

Iowa Legislature: Cities Anxious Over The Fate Of, 50% OFF

Related products

You may also like

Stylish Ways to Rock Green Jeans

Palestinian and Israeli Teens Swam in the Same Pool. Then Came Oct

Nike Indy Women's Light-Support Padded Sports Bra (Plus Size). Nike IL

PLAYBOOK, Exciting News Alert! Join us in celebrating the appointment of Sara Abdulhadi as CEO of Gulf International Bank (@gulfintlbank ) in Bahra

$ 12.99USD

Score 4.6(145)

In stock

Continue to book

You may also like

Stylish Ways to Rock Green Jeans

Palestinian and Israeli Teens Swam in the Same Pool. Then Came Oct

Nike Indy Women's Light-Support Padded Sports Bra (Plus Size). Nike IL

PLAYBOOK, Exciting News Alert! Join us in celebrating the appointment of Sara Abdulhadi as CEO of Gulf International Bank (@gulfintlbank ) in Bahra

$ 12.99USD

Score 4.6(145)

In stock

Continue to book

©2018-2024, followfire.info, Inc. or its affiliates