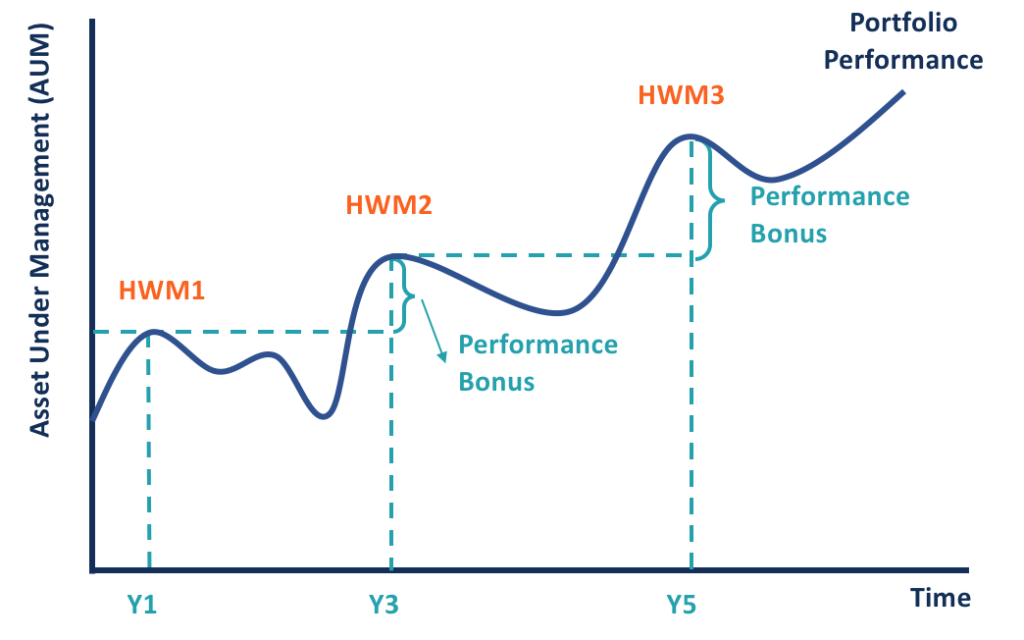

High-Water Mark - Example, Definition, vs Hurdle Rate

High-water mark is the highest level of value reached by an investment account or portfolio. It is often used as a threshold to determine

Hedge Fund Primer Investment Strategies

Performance Fees - FasterCapital

:max_bytes(150000):strip_icc()/four-7f4d092fa74249a69b40c377acf2aa81.jpg)

What Is a High-Water Mark?

Simple Performance Fee Calculation for Investment Funds

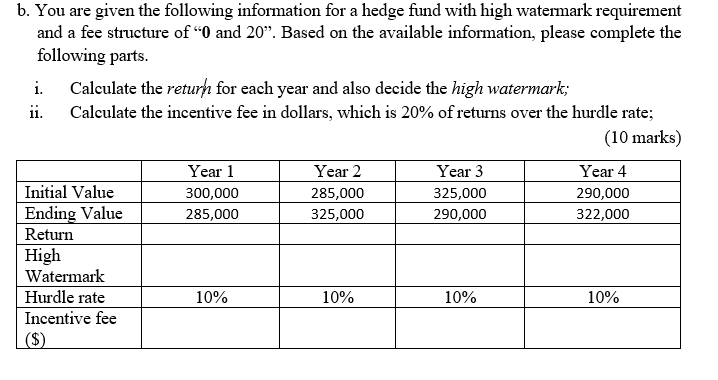

Solved b. You are given the following information for a

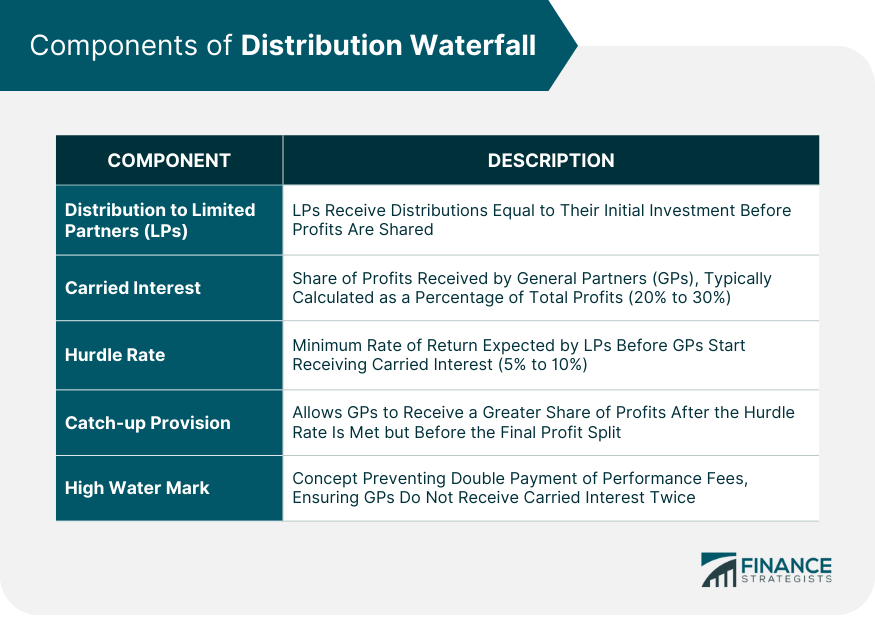

Distribution Waterfall Definition, Components, and Impact

Solved (1) Why do you think that banks are regulated to

Mark High's Instagram, Twitter & Facebook on IDCrawl

:max_bytes(150000):strip_icc()/highwatermark.asp-final-7d11fbb52cab4b7f954bb0cb9799ec36.png)

High-Water Mark: What It Means in Finance, With Examples

Hurdle Rate (soft vs hard) - Alternative Investments - AnalystForum

Performance Fee Definition, Key Components, Benefits & Risks

Aggregate Gains, Losses, and Incentive Fees, by Year For each fund in

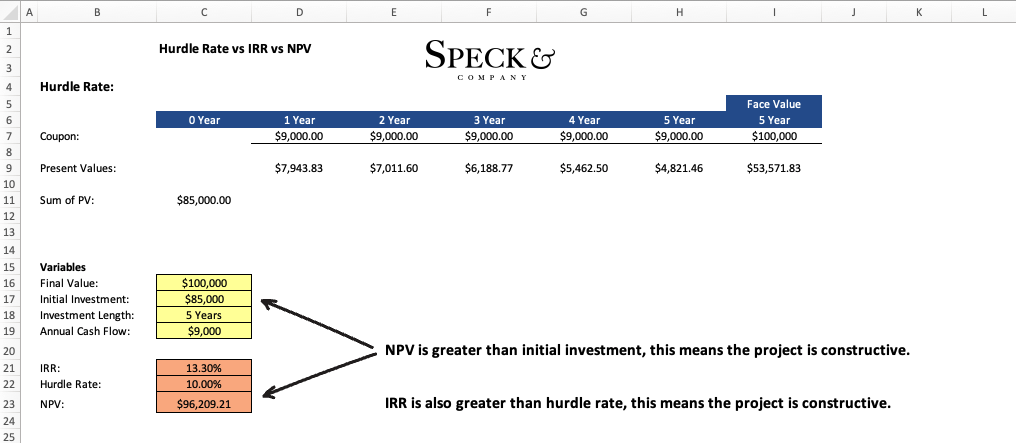

Hurdle Rate – Definition, Explanation, & Example – Speck & Company

Mark High's Instagram, Twitter & Facebook on IDCrawl

SICAV Performance Fee Guide