Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

The relationship and interaction between Ohio law governing not-for-profit organizations and the Internal Revenue Code provisions governing tax-exempt and charitable organizations can be confusing and often misunderstood. Many people assume that one necessarily means the other, which is not the case.

Federal implications of passthrough entity tax elections

Ohio REALTORS Ohio's Real Estate Trade Organization

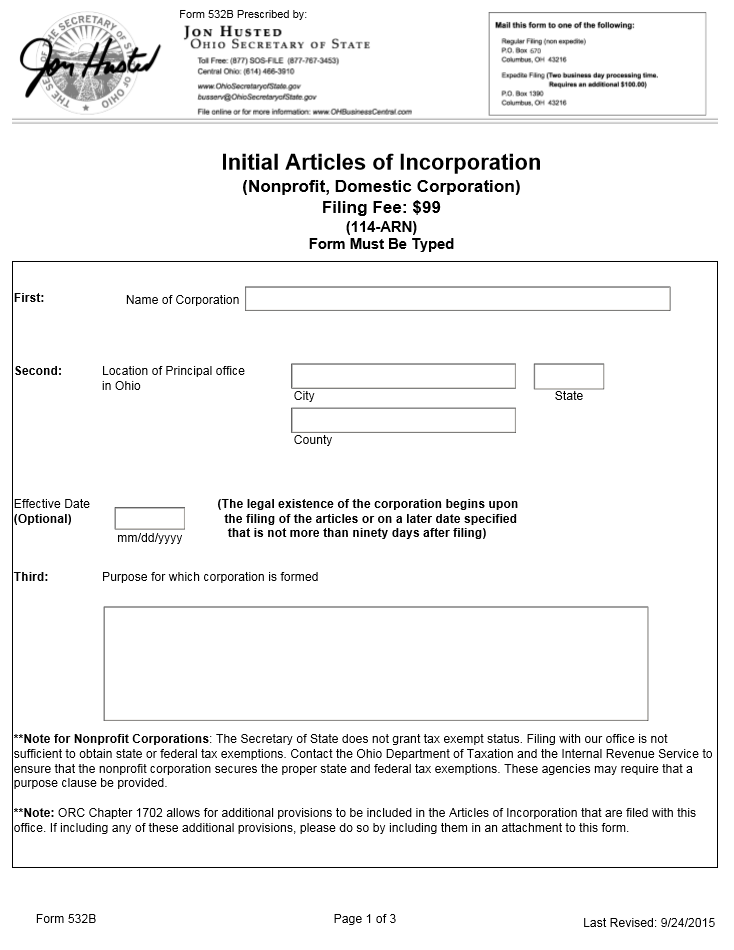

Free Ohio Nonprofit Articles of Incorporation Nonprofit Domestic Corporation

What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status - Foundation Group®

What You Should Know About Sales and Use Tax Exemption Certificates, Marcum LLP

Baldwin's Ohio Revised Code Annotated comprises a comprehensive research tool for anyone desiring instant access to Ohio statutes, constitution, and

Baldwin's Ohio Revised Code Annotated (Annotated Statute & Code Series)

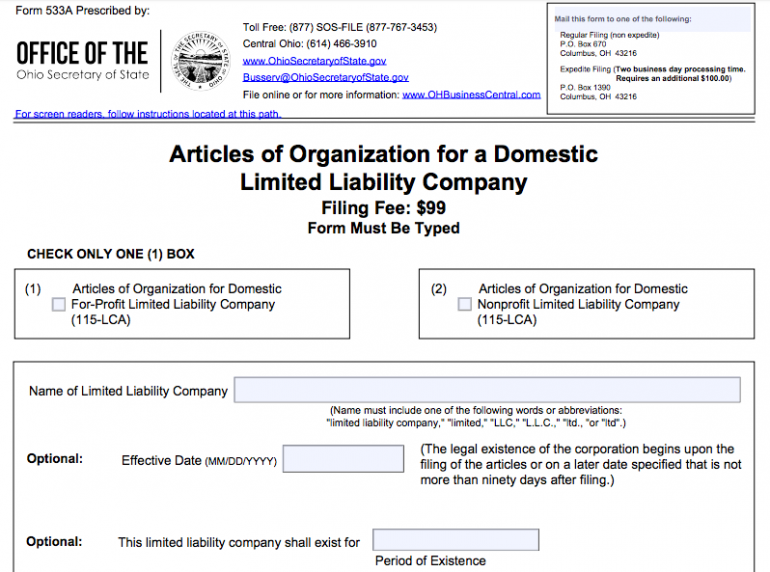

Forming an LLC in Ohio: A Step-by-Step Guide - NerdWallet

2024 State Income Tax Rates and Brackets

Sales and Use - Applying the Tax

Free Cash Donation Receipt - PDF

What are Taxable Gross Receipts Under Ohio's Commercial Activity Tax?

Charitable Gaming - CHARITABLE OHIO

Ohio Corporate Bylaws - Northwest Registered Agent

What Can I Do If a Nonprofit Isn't Following Its Bylaws?