:max_bytes(150000):strip_icc()/twenty-eight-thirty-six-rule.asp_final-8aea4a4d663140c1865477bb578fcddd.png)

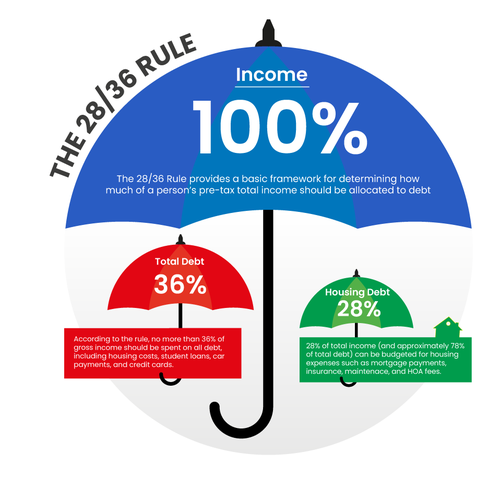

The 28/36 rule calculates debt limits that an individual or household should meet to be well-positioned for credit applications. It measures income against debt.

Infographic for homebuyers: 28/36 rule, Illustration or graphics contest

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is the 28/36 Rule of Thumb for Mortgages?

Average Student Loan Payment [2023]: Cost per Month

Time-limited Specials 28 Life-Changing Household Items an Editor Recommends, useful household items

The Peter Principle: What It Is and How to Overcome It, rule 63 definition

How much house can you afford? The 28/36 rule will help you decide

:max_bytes(150000):strip_icc()/GettyImages-92706711-5806f3813df78cbc28b068ed.jpg)

How to Set a Budget for Buying Your First Home

Conflicting Advice on How Much to Spend On A Home

How Much House Can I Afford? Calculating Mortgage Affordability Before You Buy — Vision Retirement

cdn./Calculators/Images/home-affordabi

Kuroo Tetsurou Haikyuu Mobile 2030794 [] for your , Mobile & Tablet. Explore Nekoma High . Nekoma High , High Def High Definition, High Definition HD phone wallpaper, rule 63 definition

What Is the 28/36 Rule in Mortgages? - SmartAsset

How much of your income you should spend on housing

:max_bytes(150000):strip_icc()/shutterstock_579740932.dollars-5c4bd0fbc9e77c00014af9e0.jpg)

Housing Expense Ratio: What it is, How it Works

28/36 : 🌐 McKinsey's Pyramid Framework for storytelling