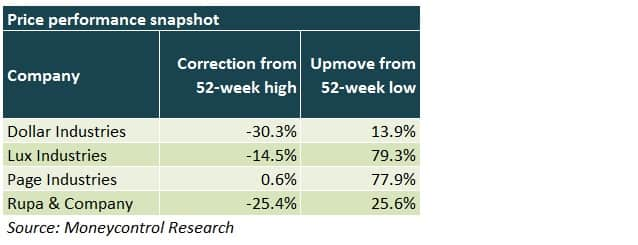

Ideas For Profit Dollar & Rupa: Value innerwear stocks to outperform despite COVID-led disruptions

Value innerwear players, Dollar Industries and Rupa & Company, posted strong double-digit earnings growth YoY in Q2FY22. Volume growth on account of increased demand, following the unlocking measures as well as price hikes, helped deliver earnings growth. Also, given the essential nature of the segment, it is likely to outperform in a scenario of lockdowns or restrictions, if there is a third wave of COVID-19. Any weakness in the stock price would be an opportunity to add both Dollar and Rupa in the portfolio. Watch the video to find out which stock you should bet on.

Value innerwear players, Dollar Industries and Rupa & Company, posted strong double-digit earnings growth YoY in Q2FY22. Volume growth on account of increased demand, following the unlocking measures as well as price hikes, helped deliver earnings growth. Also, given the essential nature of the segment, it is likely to outperform in a scenario of lockdowns or restrictions, if there is a third wave of COVID-19. Any weakness in the stock price would be an opportunity to add both Dollar and Rupa in the portfolio. Watch the video to find out which stock you should bet on.

PDF) THE NEW INVESTMENT POLICY: ISSUES AND CHALLENGES IN THE COVID

Innerwear and leisurewear companies: Solid execution and steady

59 sustainable products our editors can't stop using in 2023

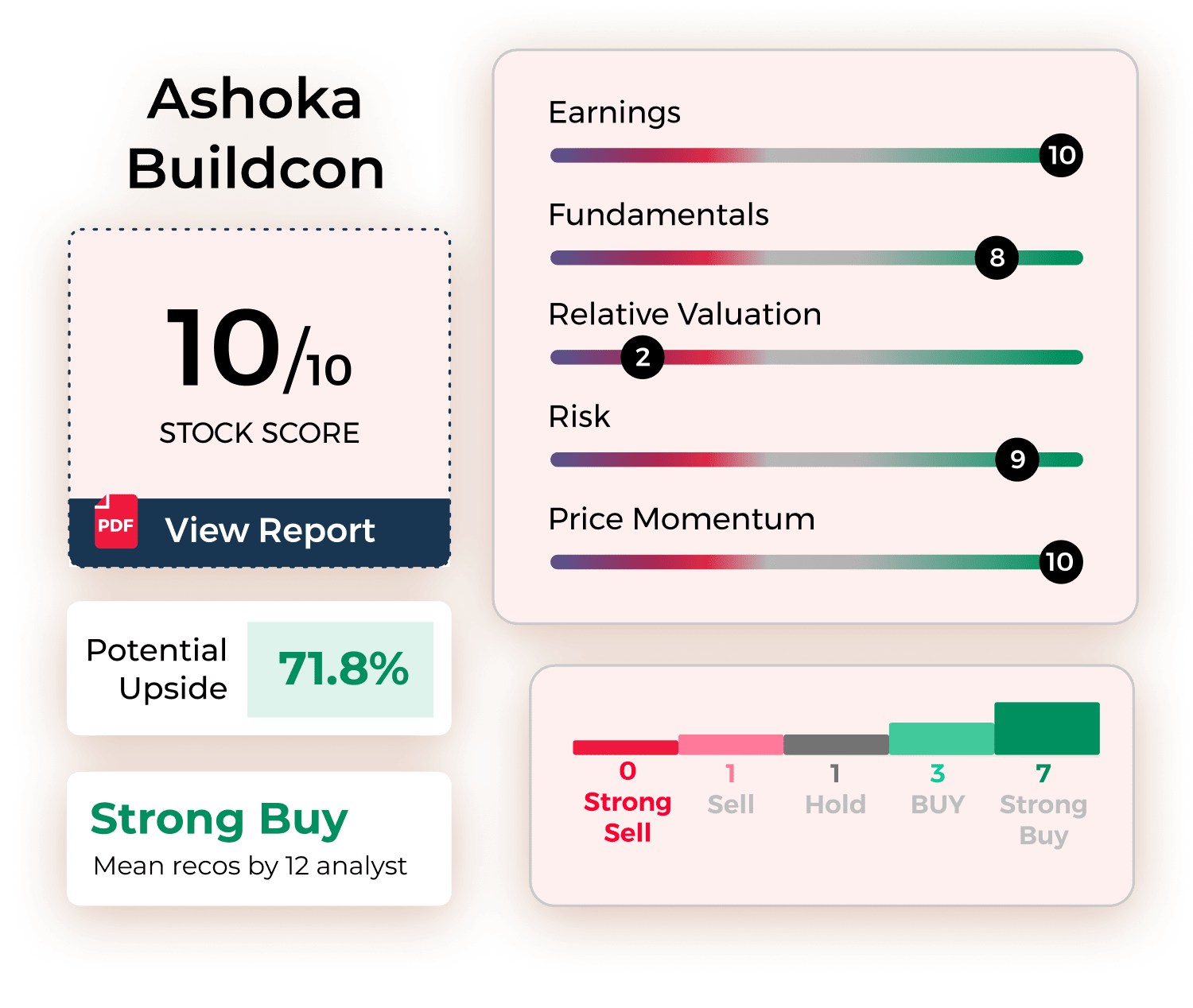

14 Profit-Making Stocks to Buy, Including One With 181% Upside: BofA

Inflation: Why Jockey, Lux, Rupa still hold an invisible pull

U.S. consumer sector braces for slowing demand as inflation bites

How does the stock of Trent limited look like for long term

Can Stocks Of Dollar Industries & Rupa Continue To Outperform

Inflation: Why Jockey, Lux, Rupa still hold an invisible pull

Ideas For Profit Dollar & Rupa: Value innerwear stocks to outperform despite COVID-led disruptions

The Strain Of COVID On Retailers – How Vertical Integration Gives