Lululemon Stock Pops On High Chinese Demand and Positive Earnings Report

:max_bytes(150000):strip_icc()/GettyImages-1249697759-71cce5fa34ec481689a68c2a71ef2d88.jpg)

Net revenue grew by 52% in international markets, boosting gross profits by 23% as Lululemon Athletica projects 18% revenue growth for 2023.

因三次巧合創業、花不到30 年就打趴愛迪達!lululemon 的創立故事

Lululemon Athletica (NASDAQ:LULU) jumps 4.9% this week, though earnings growth is still tracking behind five-year shareholder returns

Lululemon: Set To Outperform Yet Again In 2024 (NASDAQ:LULU

Chinese consumers are flocking back to high-end goods as Lululemon reports a 79% jump in China sales

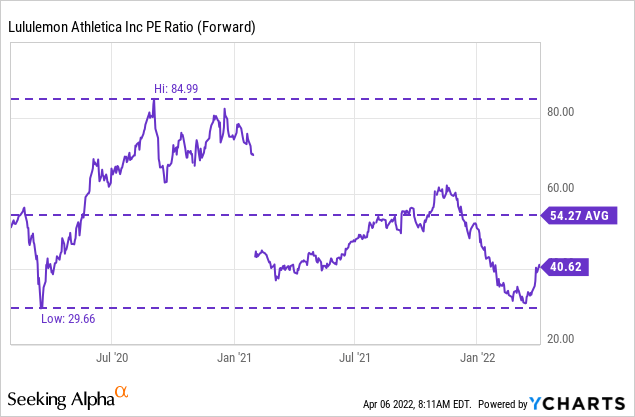

Lululemon Stock Is Down 34% From Its High. Time to Buy?

Lululemon continues to believe in Chinese market opportunities

Lululemon Stock (NASDAQ: LULU): Robust Growth to Support the Bulls

lululemon Athletica Inc. - It's all about branding

:max_bytes(150000):strip_icc()/GettyImages-1495444866-11615e67070c4fb3bfa843bf2ad636c2.jpg)

Lululemon Stock Pops On High Chinese Demand and Positive Earnings

What Time Is Lulu Earnings Report Time International Society of Precision Agriculture

Lululemon: 3 Key Drivers For 2022 (NASDAQ:LULU)

Lululemon (LULU) stock forecast: Will it continue rising?