Low-Income Housing Tax Credit Could Do More to Expand Opportunity

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

How a Tax Incentive for Clean Energy in the Inflation Reduction Act Could Affect Low-Income Communities

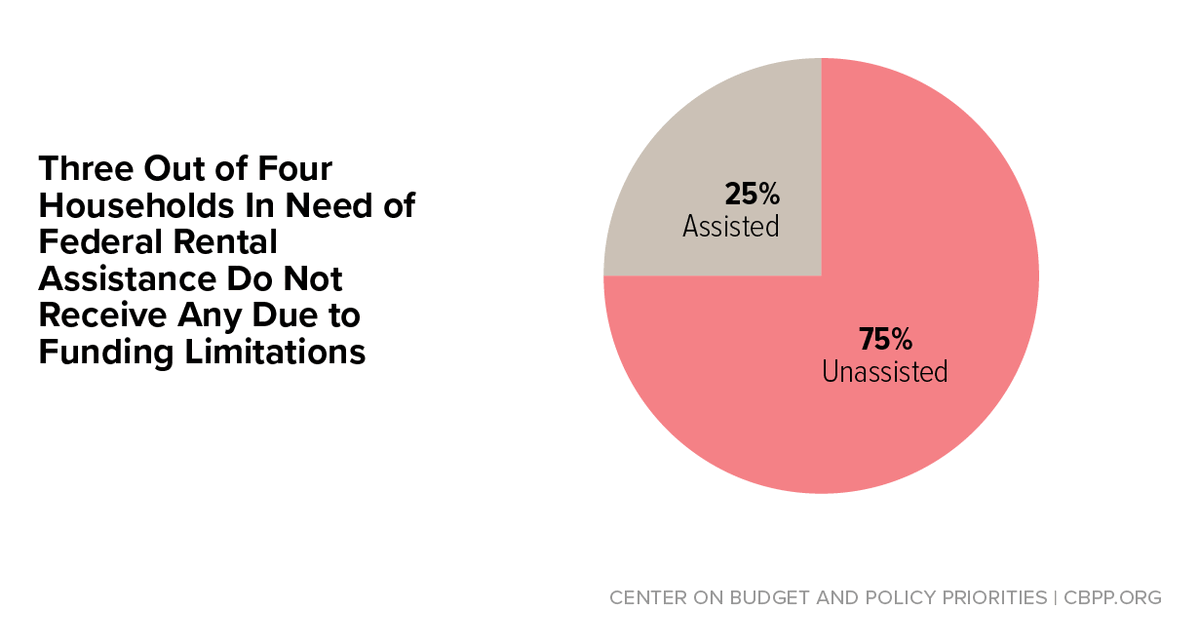

Housing and Health Partners Can Work Together to Close the Housing Affordability Gap

Improving Low-Income Housing Tax Credit Data for Preservation – New Report by NLIHC and PAHRC!

Butler Snow 2023 Texas Legislative Updates to Low Income Housing Tax Credit Developments

A D.C. Suburb Finds a Creative Answer to America's Housing Shortage - The New York Times

Equity and Climate for Homes - Circulate San Diego - Staging Environment

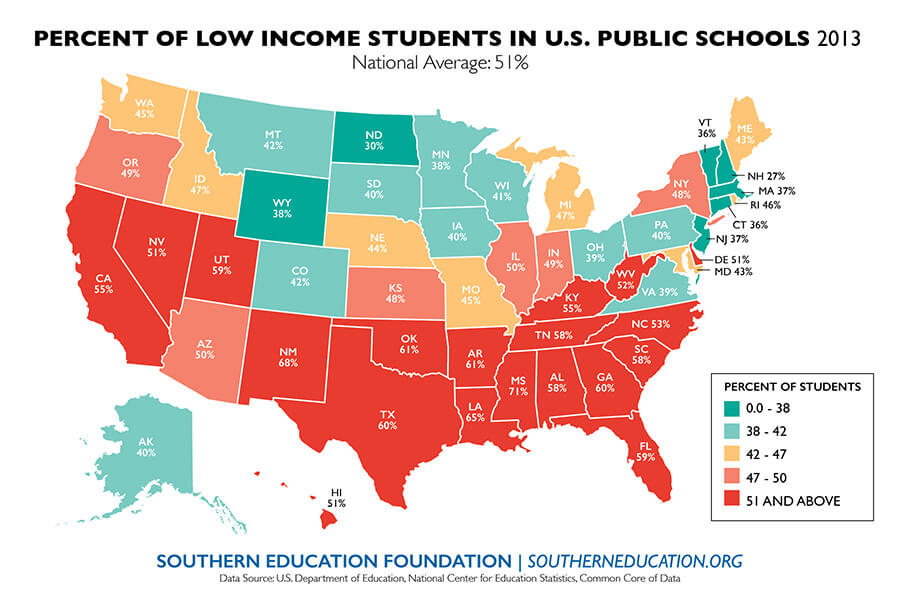

Low-Income Housing Tax Credit Could Do More to Expand Opportunity for Poor Families

Housing Tax Credit Program Georgia Department of Community Affairs

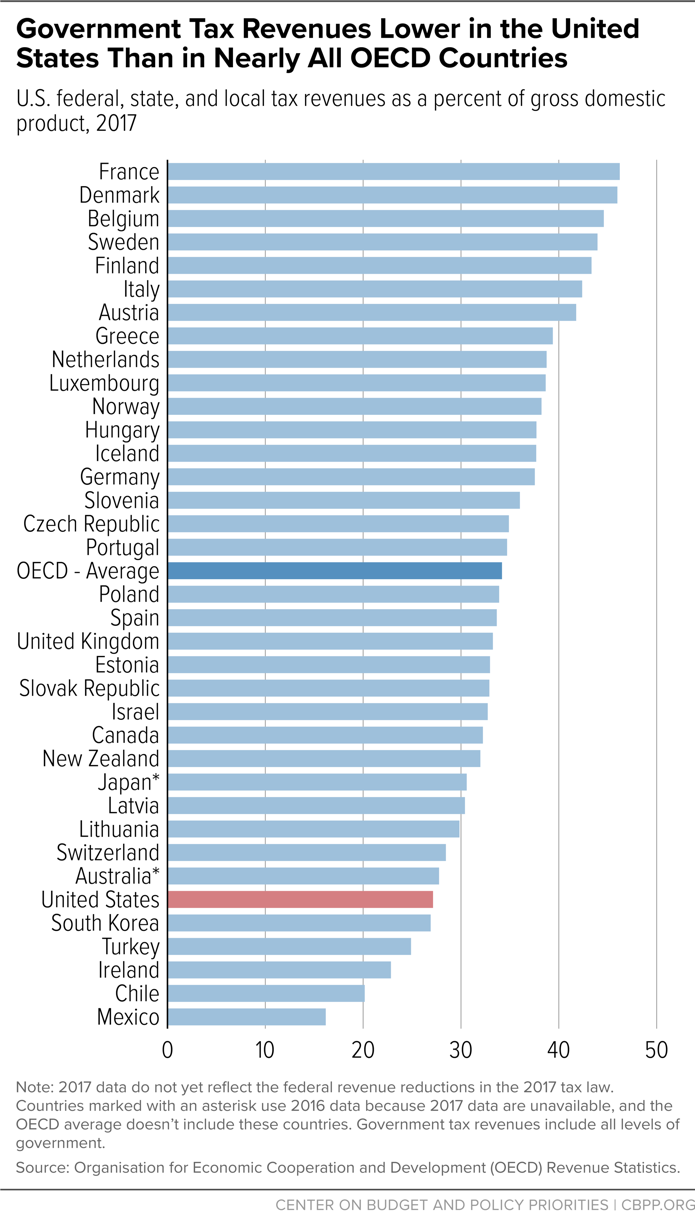

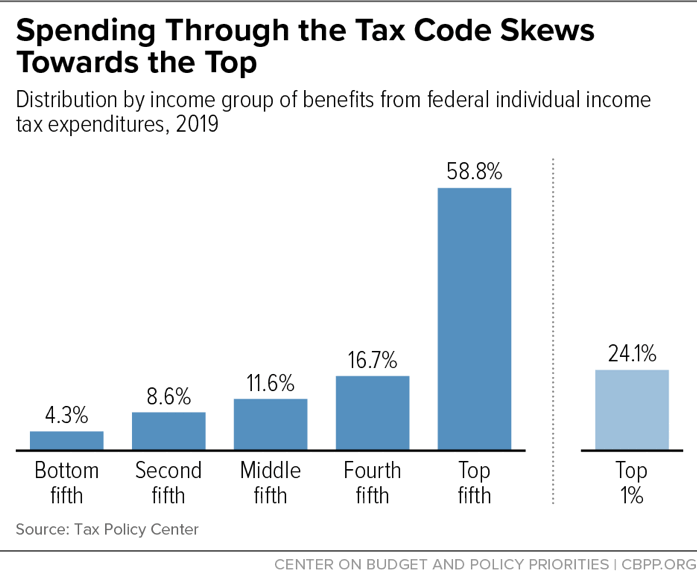

How the Federal Tax Code Can Better Advance Racial Equity

Using LIHTC to Expand Access to Opportunity

Low-Income Housing Tax Credit Could Do More to Expand Opportunity for Poor Families

A Crucial Moment for the Housing Credit and the Future of Affordable Housing

:max_bytes(150000):strip_icc()/GettyImages-1085640694-4130219ce3144af4b0812151c2a3c785.jpg)

Low-Income Housing Tax Credit (LITHC): How It Works

How the Federal Tax Code Can Better Advance Racial Equity