lt;div style = "width:60%; display: inline-block; float:left; "> This post shows how to calculate a carry and roll-down on a yield curve using R. In the fixed income, the carry is a current YTM like a dividend yield in stock. But unlike stocks, even though market conditions remain constant over time, the r</div><div style = "width: 40%; display: inline-block; float:right;"><img src=

Carry and Roll-Down of USD Interest Rate Swaps in Excel with Bloomberg Comparison - Resources

R code snippet : Transform from long format to wide format

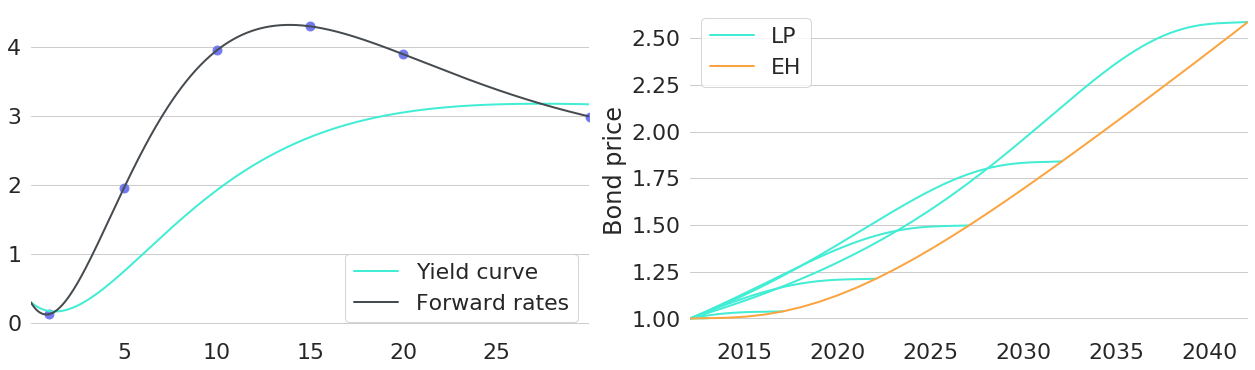

Rolling Down the Yield Curve

R code snippet : Transform from long format to wide format

Riding the Yield Curve and Rolling Down the Yield Curve Explained

Keep Calm and “Carry and Roll” On

Roll down yield on upwards sloping YC : r/CFA

Yield curve: Analyzing Yield Curves in Carry Trade Decision Making - FasterCapital

Applied Sciences, Free Full-Text