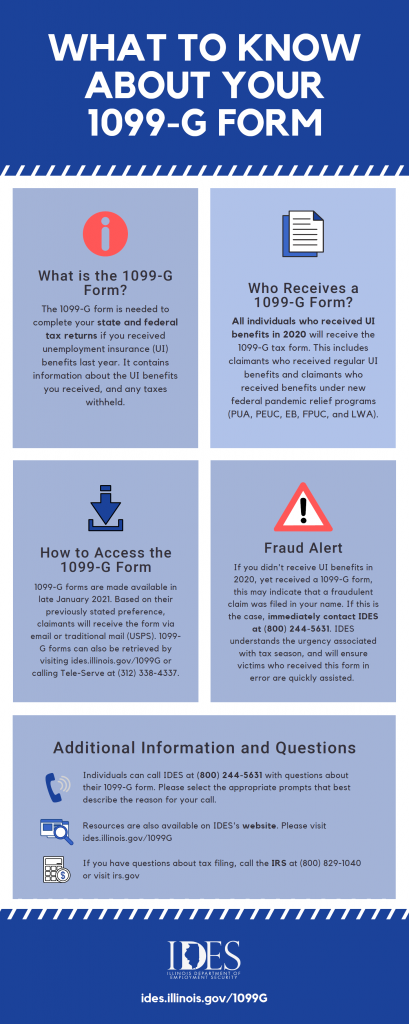

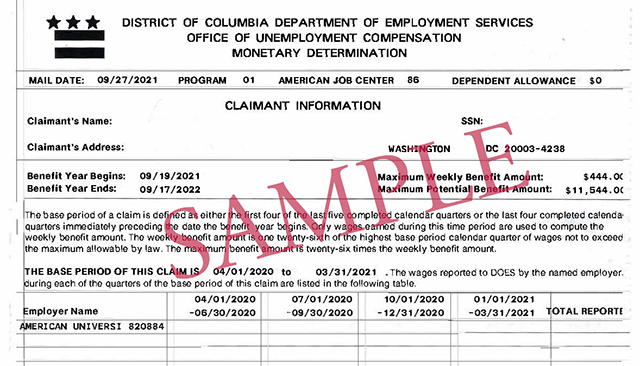

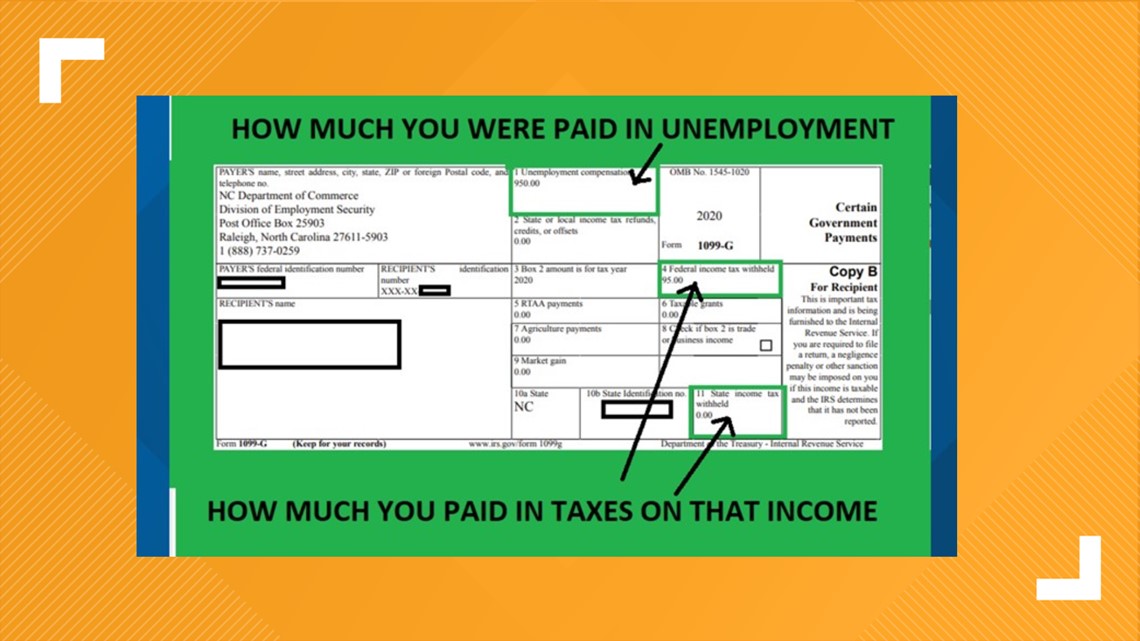

If you received unemployment compensation during the year, you should receive the 1099-G tax form. If you got the form and didn't receive jobless benefits, you could be the victim of identity theft.

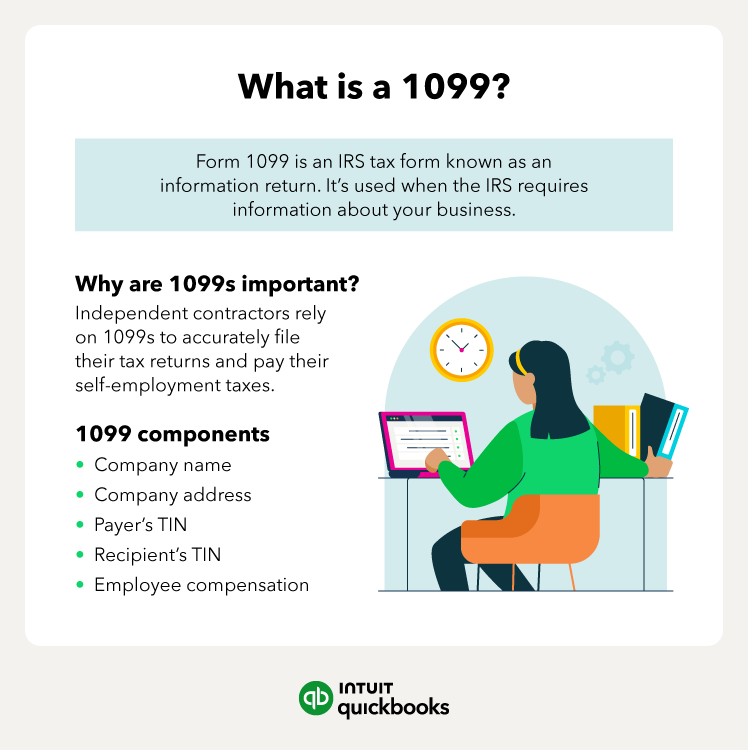

What Is a 1099 Form—and How Does It Affect Your Expat Taxes?

Tax Form 1099-G Available Online for Individuals Who Received Unemployment Benefits from Missouri in 2022

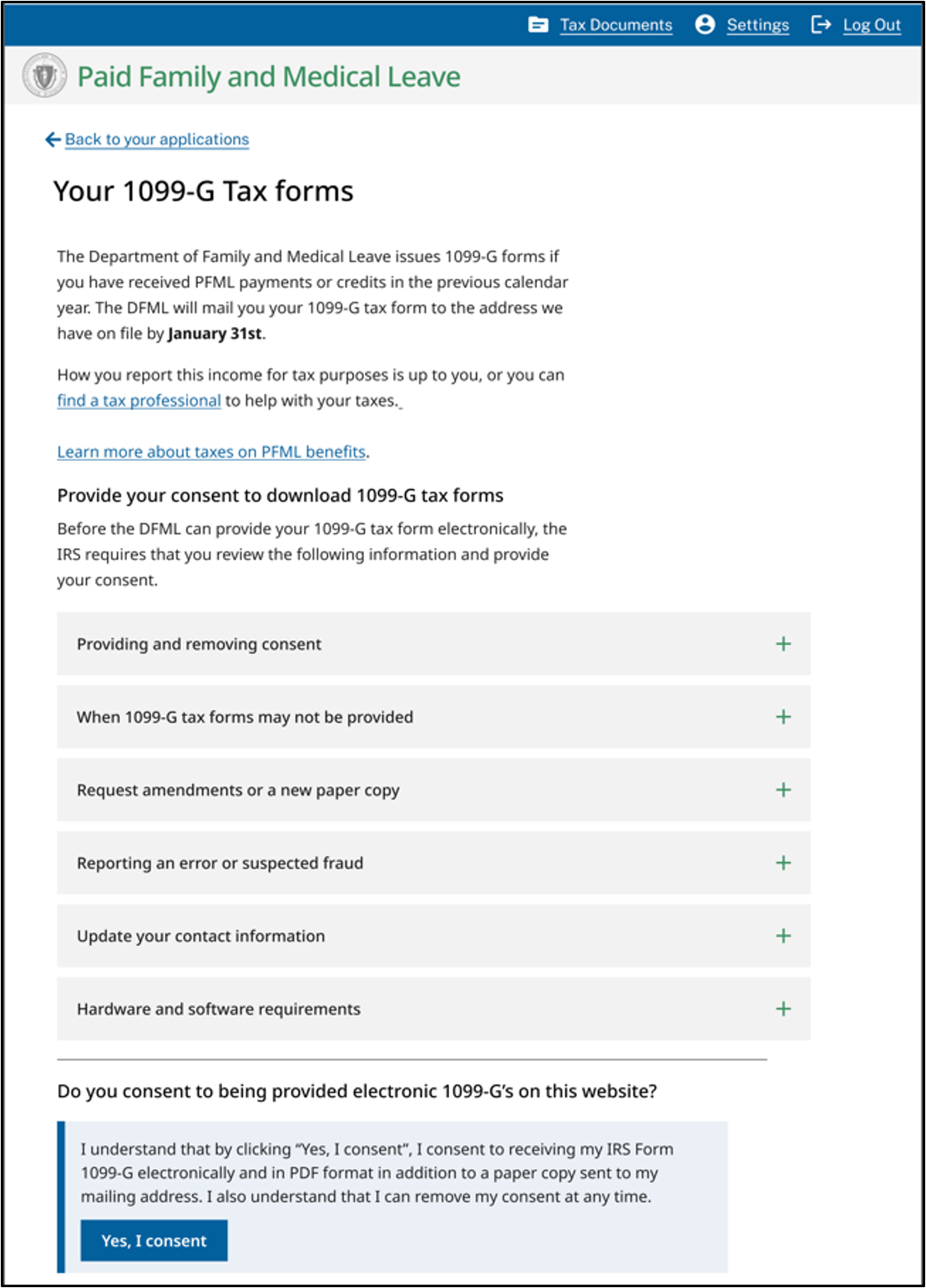

Downloading your PFML 1099-G tax form

How to Report your Unemployment Benefits on your Federal Tax Return – Get It Back

:max_bytes(150000):strip_icc()/FORM1099-INTcopy-a8b728a7d75b4b8894837312523f37b6.jpg)

Form 1099-INT: What It Is, Who Files It, and Who Receives It

AG Nessel, UIA Alert Residents Of Tax Form For Victims Of, 49% OFF

LEO - Your 1099-G Tax Form

Missing An IRS Form 1099 For Your Taxes? Keep Quiet, Don't Ask!

Understanding Form 1099-G - Jackson Hewitt

What to know about your 1099-G Form - Ryan Spain

AG Nessel, UIA Alert Residents Of Tax Form For Victims Of, 49% OFF

What is a 1099? Types, details, and how to use it

1099 Tax Forms: Everything You Need to Know - Ramsey

Arizona Department of Revenue - ADOR's Form 1099-G can be obtained at AZTaxes.gov. This is for those who itemized on their federal return and received an Arizona income tax refund. The Arizona

Will I get taxed on my unemployment benefits?